Transform your hotel operations with Smart solutions

Streamline your workflow, reduce manual tasks, and boost efficiency.

Discover our products.png?width=1024&height=826&name=carlijn0729_Happy_hotel_customer_interacting_with_hotel_staff_de39cf88-3ad0-4ccf-8f7a-d137502afec8_0%20(1).png)

Benefits of Smart Payments

All payments processed automatically, eliminating manual tasks while ensuring the lowest transaction costs.

-

Automated Payments

-

PCI Secure

-

Backup Process

-

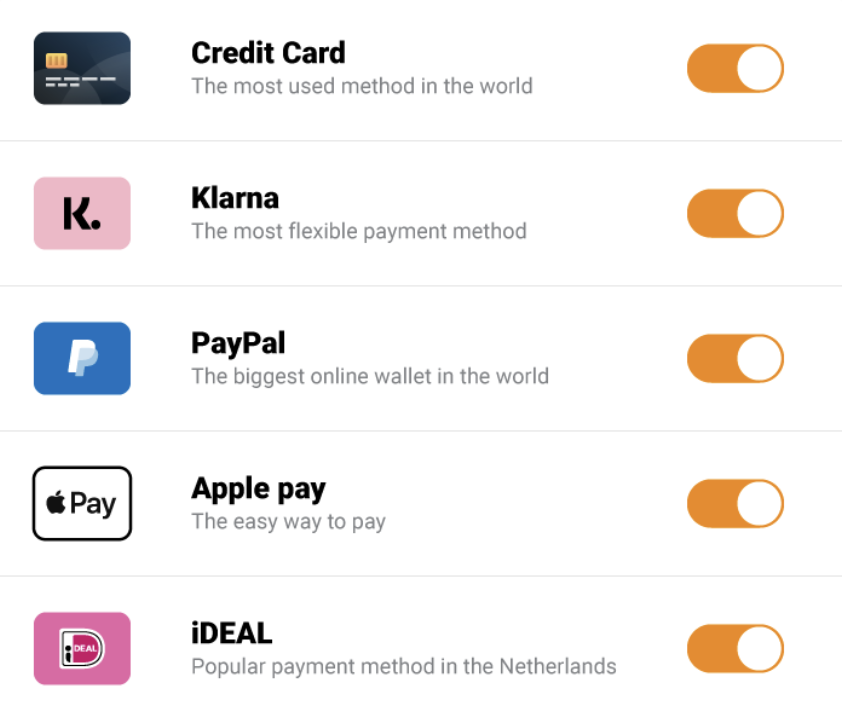

Customizable Methods

-

Single PSP

Lower transaction costs and no more manual work

All online and offline bookings are automatically charged without manual intervention, reducing labor costs and the chance of human errors. The system fully adheres to the hotel's payment policies, and includes a direct callback to the guest folio in the PMS, ensuring it is always up to date.

PCI Compliance

Smart Payments is fully PCI compliant, which limits liability for hotels. There is no handling or storage of credit card data by staff or within the PMS, reducing risk and enhancing security.

Backup process for failed payments

If a payment cannot be processed, Smart Payments has a backup process in place. For example, a paylink can be sent via email automatically to keep prepayments in order.

Customizable Payment Methods

Hotels have the flexibility to choose which payment methods to activate or deactivate, allowing for tailored payment options that suit their needs.

Single Payment Service Provider

By using one payment service provider, Smart Payments offers more transparent and clear reconciliation with a lower error margin. Additionally, increased volume through a single provider can lead to reduced costs.

Automatic VCC charges

OTA prepayments settled via virtual credit cards are processed automatically without manual intervention. This saves time, reduces errors, and ultimately improves cash flow for the hotel.

Payment links

Easily secure bookings by sending payment links directly to guests,. Our payment links provide a quick, secure way for guests to pay online, streamlining the process and reducing manual work.

Payment page

Our payment page connects directly to the booking module, making the booking process easy and efficient for guests.

Pin terminal

A state-of-the-art, fully integrated PIN terminal, tailored to your hotel’s requirements and connected to the same merchant account as your eCommerce solution, ensures seamless reconciliation and volume-based benefits.

Ready to streamline your payments?

Schedule a 15-minute call to discuss your challenges and discover how we can help you.

Or ask us via +31 30 782 0590 or the contact form

“Smarthotel's payment solutions have streamlined our financial processes and improved overall efficiency.”

Grand Hotel Karel V - Utrecht

Smart Channel Manager

Effortlessly manage all your booking channels in one place with our Channel Manager, ensuring real-time updates and maximizing your room sales without the hassle.

-

Boost Online Revenue

Boost Online Revenue

Increase your property's visibility by showcasing it across top-performing booking channels tailored to your target market. This expanded reach leads to more exposure and higher bookings, directly impacting your bottom line. -

Prevent Overbookings

Prevent Overbookings

The Smart Channel Manager automatically synchronizes all your booking channels, ensuring real-time updates on room availability. This synchronization minimizes the risk of overbookings and enhances guest satisfaction. -

Reduce Manual Work

Maximize Revenue with Channel Management

Save time and effort by managing all prices and availability in one central system (PMS). The Channel Manager distributes this information across all connected booking sites, offering the most efficient way to handle your online sales. -

Maximize Last Room Sales

Maximize Last Room Sales

Make the most out of your remaining inventory by seamlessly offering your last available rooms on multiple channels. This ensures you capture every possible booking opportunity. -

Expert Support and Consultancy

Expert Support and Consultancy

Our in-house team provides personalized support and consultancy, understanding the unique needs of hoteliers. With fast response times and industry expertise, we're here to help you make the most of your online sales strategy.

Boost Online Revenue

Increase your property's visibility by showcasing it across top-performing booking channels tailored to your target market. This expanded reach leads to more exposure and higher bookings, directly impacting your bottom line.

Prevent Overbookings

The Smart Channel Manager automatically synchronizes all your booking channels, ensuring real-time updates on room availability. This synchronization minimizes the risk of overbookings and enhances guest satisfaction.

Maximize Revenue with Channel Management

Save time and effort by managing all prices and availability in one central system (PMS). The Channel Manager distributes this information across all connected booking sites, offering the most efficient way to handle your online sales.

Maximize Last Room Sales

Make the most out of your remaining inventory by seamlessly offering your last available rooms on multiple channels. This ensures you capture every possible booking opportunity.

Expert Support and Consultancy

Our in-house team provides personalized support and consultancy, understanding the unique needs of hoteliers. With fast response times and industry expertise, we're here to help you make the most of your online sales strategy.

“Smarthotel employees know what they are doing and ensure fast results”

We have a great collaboration with Smarthotel and are very satisfied with the results. Our challenge is to continue improving room sales through promotions on various online channels linked to Smarthotel, where they provide us with valuable guidance. You receive resourceful assistance over the phone, and adjustments are made immediately. We highly recommend Smarthotel to other hotels. Their employees are knowledgeable and ensure fast results.

Hotel Arrows - Uden

“Smarthotel's automated prepayment system has transformed how we manage bookings, saving time and reducing errors.”

By automating our prepayment processes with Smarthotel, we've reduced administrative burdens and improved the experience for our guests. The system's flexibilty to handle multiple accomodation types and pricing rules has been invaluable for our operations.

Resort Portavadie, Loch Fine - Scotland

“Smarthotel's payment solutions have streamlined our financial processes and improved overall efficiency."

We worked very closely with Smarthotel to implement their Smart Payment system. It has significantly reduced our workload by automating financial reconciliations, ensuring a smooth experience for both guests and staff. Their expertise and innovative approach were crucial to the success of the project.

Grand Hotel Karel V - Utrecht

“Smarthotel technology has greatly improved our operational efficiency and reduced manual work.”

The implementation of Smarthotel's Smart Payment system has eliminated manual payment entries, saving time for our front-office staff and ensuring seamless integration with our systems. We've seen major benefits in terms of speed and accuracy in guest services.

Ramada Inn - Scheveningen

“Smarthotel's embedded payment solutions created a seamless experience for both our guests and our staff.”

Partnering with Smarthotel, we implemented an integrated payment system, which included embedding payment functionalities, automating payment links, and integrating terminals across multiple touchpoints. These changes simplified operations, enhanced payment security, and improved the guest experience.

Sunborn Yacht Hotel - London

.jpg?width=2000&height=1334&name=Karel-V-Nslagmolen-28-juli-2021-52-scaled%20(1).jpg)

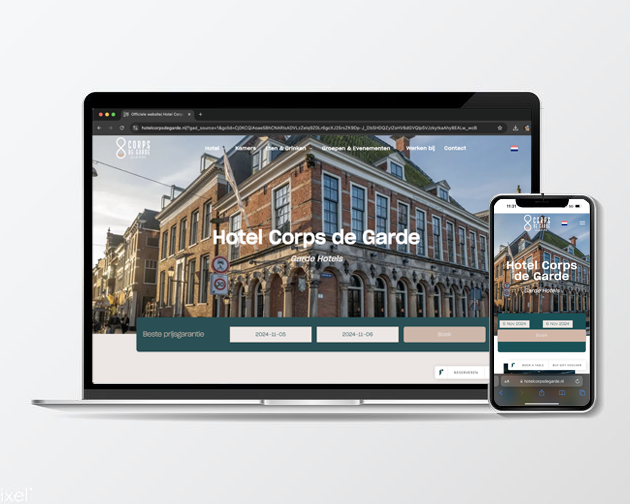

Smart Websolutions

Want to receive more commission-free bookings? You can, with the suite of Smart websolutions. The guest-friendly booking system increases the number of bookings through your own website.

-

Boost Direct Bookings

-

Increase Conversion Rates

-

Fully Customizable

-

Expert Setup

-

Enhanced Interaction

Direct is Best

Increase your direct bookings and keep revenue in-house with our commission-free booking engine. Smarthotel uses data and industry insights to create a smooth booking path, encouraging guests to book directly with you.

Clicks to Guests

Turn more visitors into bookers with an optimized booking process. Smarthotel analyzes user behavior ti fine-tine each step, ensuring higher conversions and reducing dependence on third-party platforms.

Your Brand, Your way

Build a branded experience with full customization options. Smarthotel's websolutions adapt to your needs, delivering a seamless, guest-focused journey that reflects your hotel's identity.

Professionals at your service

Our hospitality and tech experts use industry knowledge and data-drive insights to set up and optimize your booking engine for maximum impact. Smarthotel ensures you're fully equipped to boost direct bookings efficiently.

Connect, Engage, Convert

Engage guests with interactive, user-centric features designed to build loyalty and encourage direct bookings, while offering a personalized experience that stands out from traditional booking channels.

Smart Hotel Websites

Convert visitors into bookers with innovative, highly customizable hotel websites, fully set up and managed by our team of experts.

Smart Booking Engine

The Smart Booking Engine drives more direct bookings, helping you maximize revenue and reduce commission costs.

Smart Conversion Booster

The Conversion Booster provides a complete toolkit to engage website visitors and encourage bookings, increasing conversion rates by an average of 15-30%.

Upgrade your hotel website today

Schedule a 15-Minute call to discuss how we can help boost your online presence.

Or ask us via +31 30 782 0590 or the contact form

“Smarthotel's embedded payment solutions created a seamless experience for both our guests and our staff.”

Sunborn Yacht Hotel - London